Course Overview

This comprehensive course is designed to equip participants with the knowledge and skills necessary to detect, investigate, and prevent financial fraud. It covers forensic accounting techniques, fraud examination methodologies, and legal considerations. Participants will learn how to analyze financial statements, identify red flags, and utilize investigative tools to uncover fraudulent activities. By the end of this course, participants will have a solid understanding of how to effectively conduct forensic accounting investigations and apply fraud examination techniques in various professional settings.

Course Duration

5 Days

Who Should Attend

- Accountants and auditors

- Financial analysts and controllers

- Internal and external auditors

- Compliance officers

- Legal professionals involved in financial litigation

- Risk management professionals

- Law enforcement officers specializing in financial crimes

Course Objectives

By the end of this course, participants will:

- Understand the principles and practices of forensic accounting.

- Learn the techniques and methodologies used in fraud examination.

- Develop the ability to detect and investigate various types of financial fraud.

- Gain insights into the legal and ethical considerations in forensic accounting.

- Enhance skills in analyzing financial statements and identifying anomalies.

- Familiarize with the tools and technologies used in forensic investigations.

- Learn how to document and report findings effectively.

- Understand the role of forensic accountants in litigation support.

Course Outline:

Module 1: Introduction to Forensic Accounting and Fraud Examination

- Overview of forensic accounting

- Types of fraud and common schemes

- The role of a forensic accountant

- Legal and ethical considerations

Module 2: Fraud Detection Techniques

- Financial statement analysis

- Identifying red flags and anomalies

- Analytical procedures and ratio analysis

- Case studies on detecting fraud

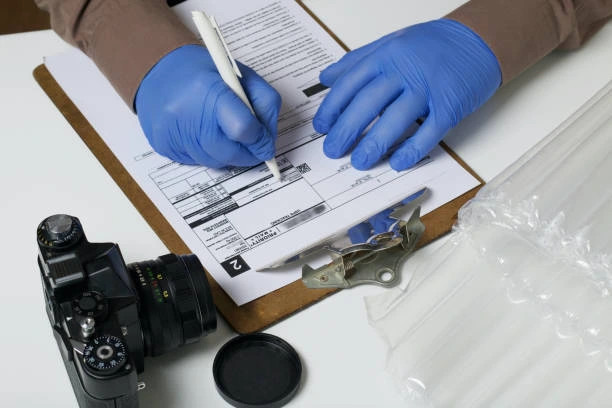

Module 3: Investigative Techniques and Tools

- Interviewing and interrogation techniques

- Gathering and preserving evidence

- Digital forensics and data analysis tools

- Case studies on investigating fraud

Module 4: Legal Aspects and Reporting

- Legal framework for fraud examination

- Preparing reports and documentation

- Testifying as an expert witness

- Case studies on litigation support

Module 5: Prevention and Mitigation Strategies

- Developing anti-fraud policies and controls

- Risk assessment and management

- Creating a fraud response plan

- Best practices for fraud prevention and deterrence